Average True Range (ATR): The Weather Vane of Stock Trading

Learn about the Average True Range (ATR), the weather vane of stock trading. ATR helps predict stock price movements, aiding in strategic decision-making. Understand its role in revealing potential trading opportunities.

Introduction

Have you ever wondered about the stock market? It's a place where people buy and sell parts of companies, called stocks, hoping to make a profit. There's a whole toolbox that traders use to decide when to buy or sell. These are called technical indicators. Let's talk about one special tool, the Average True Range (ATR), which is like the weather vane of stock trading, giving us an idea of how much a stock's price might change.

What is the Average True Range (ATR)?

Imagine a weather vane, spinning to show us how strong the wind is. The ATR is a lot like that. It's a tool that shows us how much a stock's price usually moves up or down. Just as a weather vane tells us about the wind's strength, ATR tells us about the 'strength' of price movement.

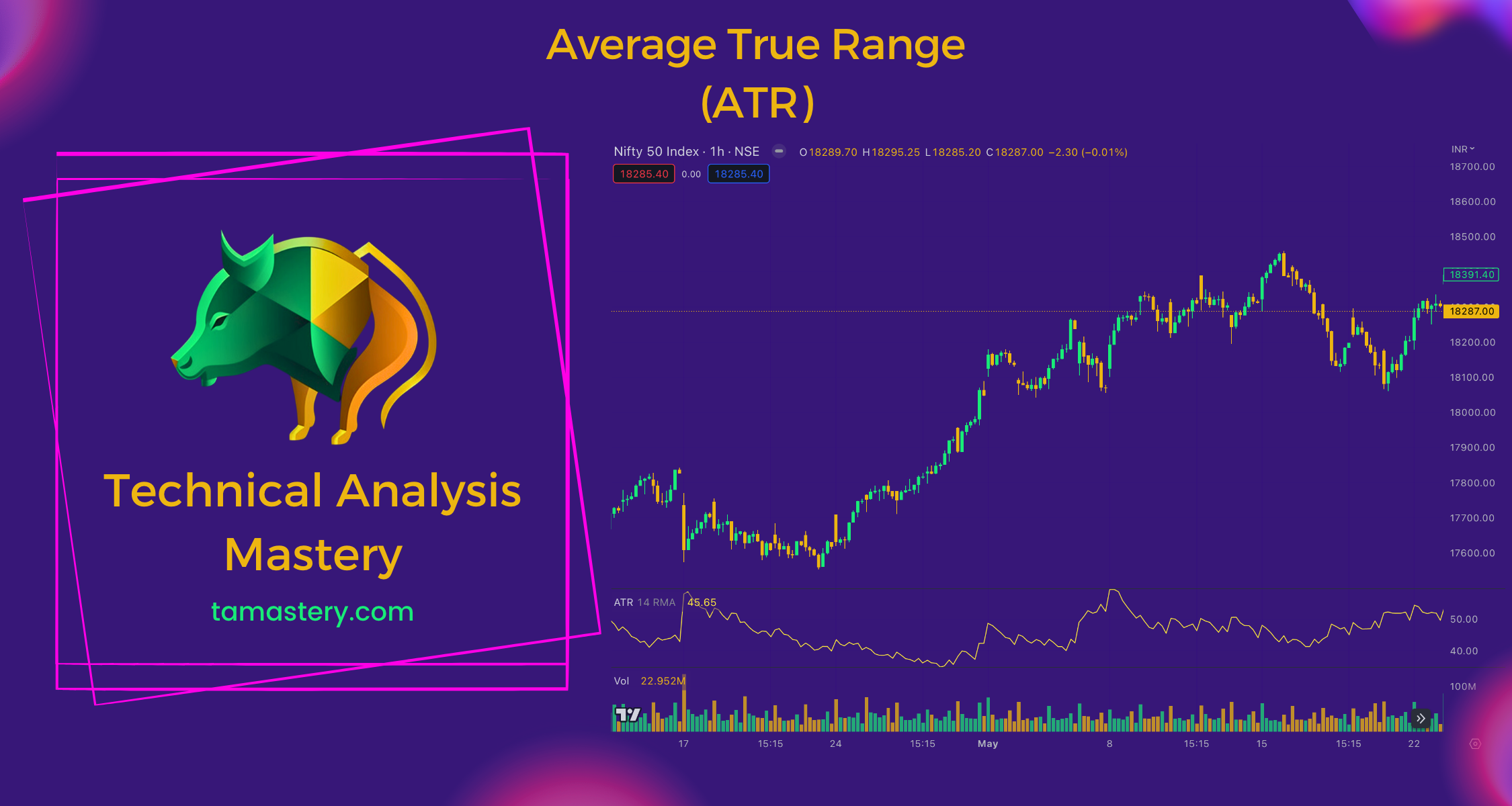

How the ATR Works So how does the ATR work?

It looks at how much a stock's price has moved each day, on average, over a certain period. Think of a weather vane. Over time, it shows us the average wind direction and speed. The ATR does something similar, showing the average 'speed' and 'direction' of a stock's price movement.

Why is the ATR Helpful in Trading?

ATR can help traders get a sense of how much a stock's price might go up or down. Just like knowing how strong the wind might blow based on a weather vane, ATR helps traders forecast how much a stock's price might 'blow' in one direction or another.

How to Use the ATR in Trading

ATR is a handy tool. If it's high, it suggests that the stock's price might move a lot. This could mean more risk, but also more opportunities. If the ATR is low, it suggests the stock's price might not move much. This could be safer, but might offer fewer opportunities for profit.

Conclusion

To sum up, the ATR is like a weather vane for trading. It helps traders understand how much a stock's price might change. But just like a weather vane can't predict the weather with absolute certainty, no technical indicator, including ATR, can predict stock prices perfectly. So keep exploring other indicators, and remember, trading is not about certain predictions, but about informed decisions.