Mastering the Stock Market Rhythm with the Ultimate Oscillator

Experience the rhythm of the stock market through the lens of the Ultimate Oscillator. This powerful trading tool provides insights into buying and selling pressures over various periods, assisting traders to align with market tempo and make informed decisions.

Introduction

Imagine the stock market as a bustling marketplace, where stocks, or small slices of companies, are swapped with the hope that they'll increase in value. Technical indicators like the 'Ultimate Oscillator' are our guides in this vibrant place. They help filter the noise and provide valuable insight into the market's future movements. The Ultimate Oscillator allows us to understand the pace of buying and selling, showing us if the market beat is fast or slow. It's a tool for guidance, not prophecy, which is why exploring other technical indicators is always wise. Let's delve deeper into the Ultimate Oscillator, understanding its purpose, operation, and value to traders.

2. What is the Ultimate Oscillator?

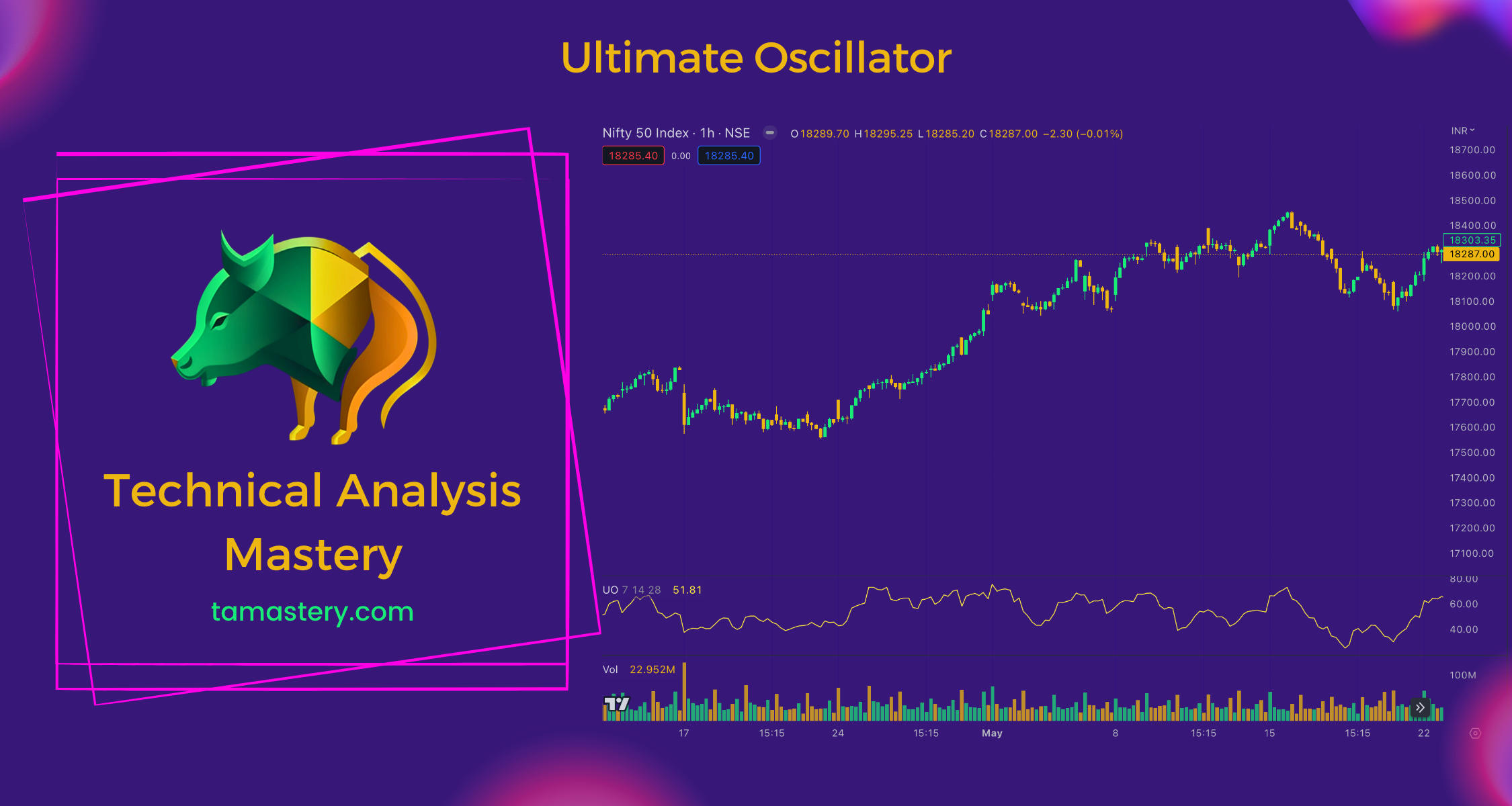

The Ultimate Oscillator, despite its grandiose name, is a tool that provides insight into the stock market's activity over different periods. Much like a speedometer in a car: when the market speeds up with buying, the oscillator goes up, and when it slows down with selling, the oscillator drops. It doesn't just focus on a single moment but analyzes three time periods—short, medium, and long. This multi-period view gives a comprehensive image of the market's activity and aids traders in making informed decisions based on market pressure.

3. How the Ultimate Oscillator Works

The Ultimate Oscillator scrutinizes short, medium, and long periods, presenting a complete image of the market's rhythm. It measures the "close price" of a stock for each period, calculating the "True Range," a measure of price change, and the "Buying Pressure," which indicates how much the close price exceeds the period's lowest price. By comparing these values across the three periods, the Ultimate Oscillator reveals the market's rhythm, providing a number between 0 and 100 that indicates buying or selling pressure. High values indicate intense buying, while low values suggest strong selling pressure.

4. The Benefits of the Ultimate Oscillator in Trading

The Ultimate Oscillator serves as the market's pulse, helping you understand the balance between buying and selling. This can inform traders of potential price changes. A high Ultimate Oscillator reading indicates strong buying pressure, signaling that the stock's price may increase, while a low reading suggests strong selling pressure, implying the price could drop.

Let's consider an example of a large tech company's stock. If the Ultimate Oscillator value was steadily above 70 for a time, this could indicate strong buying pressure and that the stock price may increase. Conversely, if the oscillator value was below 30, it might suggest a strong selling pressure and the potential for the stock price to drop.

In addition to price prediction, the Ultimate Oscillator also helps detect 'divergence', where the stock price and the Oscillator move in opposing directions. This divergence might signal upcoming changes in stock price trends.

5. How to Use the Ultimate Oscillator in Trading

The Ultimate Oscillator can be used to help traders align their moves with the market's rhythm. If the Ultimate Oscillator rises, indicating a surge in buying over selling, traders could infer that the stock's price might increase. If the Oscillator falls, showing more selling than buying, it may suggest the stock's price could drop.

Nevertheless, while the Ultimate Oscillator can provide clues about future stock price movements, it can't predict with absolute certainty. Other considerations such as company earnings reports, news, and overall economic performance should also be taken into account.

6. Conclusion

The Ultimate Oscillator is a tool that allows traders to feel the market's 'pulse'. It indicates the balance of buying and selling over various periods, giving traders insights into market behavior. But remember, it is just one tool in a trader's toolbox. Numerous factors, from economic conditions to company news, influence the stock market.

Understanding how the Ultimate Oscillator works is a great start. So keep learning about the market and the different tools available to make informed trading decisions. You'll be one step closer to becoming a savvy trader.