Rate of Change (ROC): The Speedometer of Stock Trading

Uncover the ROC's role in stock trading, working as a speedometer for price changes. Whether a stock's price is accelerating or decelerating, ROC offers valuable insights for informed trading decisions.

Introduction

Welcome back to our exciting journey in the world of stock trading, where we use technical indicators as our navigation tools. Today, let's talk about one such tool: the Rate of Change (ROC), which serves as the speedometer of trading. This tool tells us how quickly a stock's price is changing, much like a speedometer indicates the speed of a car.

What is the Rate of Change (ROC)?

The ROC is a handy tool in our stock trading toolkit. It measures how fast a stock's price is going up or down. Imagine you're driving a car. A speedometer tells you how fast you're driving, right? Similarly, the ROC tells us how quickly a stock's price is changing.

How the ROC Works

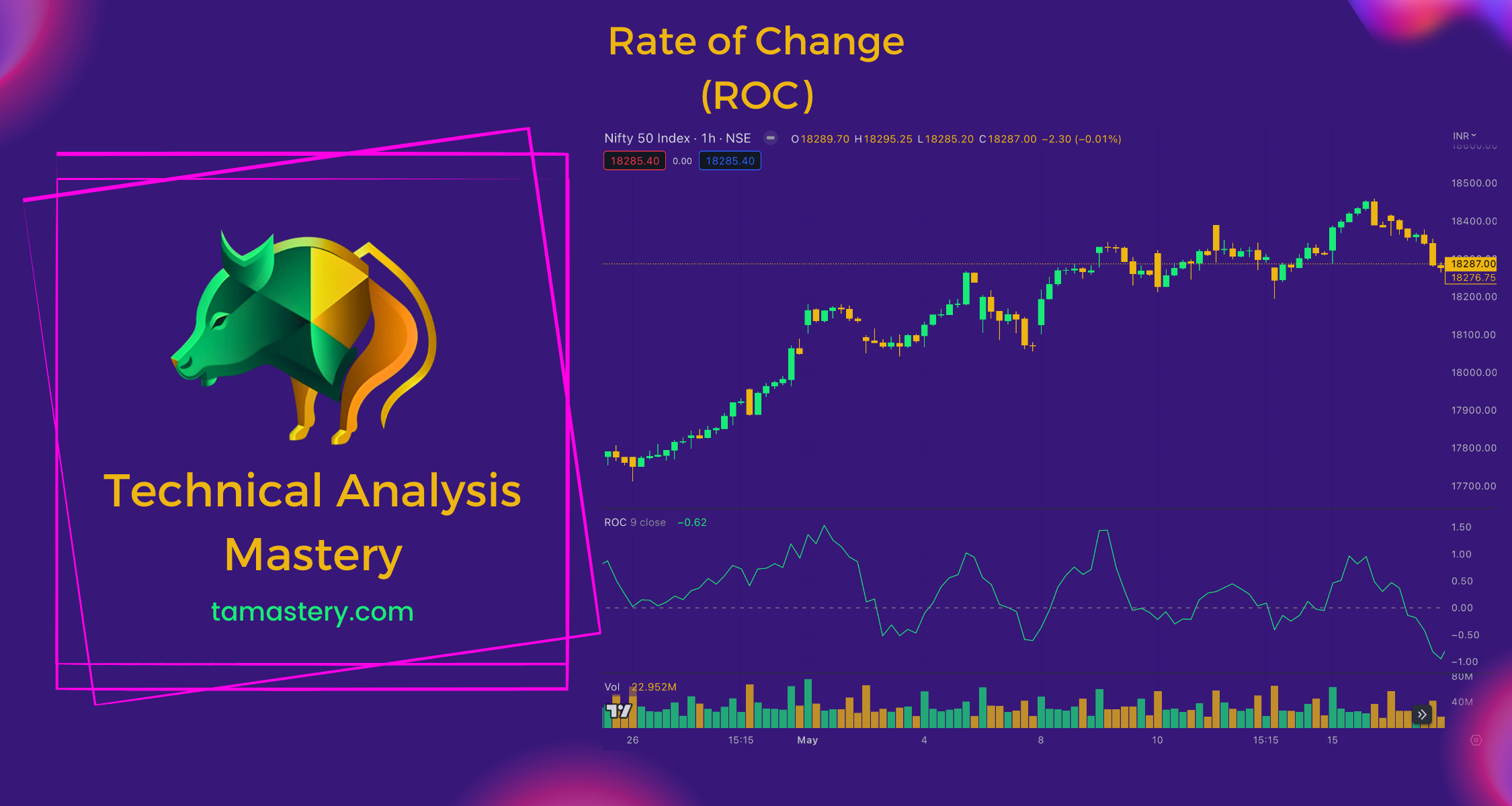

Now, let's understand how our speedometer, the ROC, works. It calculates the speed of a stock's price change by comparing the current price with its price from a certain number of days ago. It's like a speedometer gauging your speed by comparing where you are now with where you were a minute ago.

Why is the ROC Helpful in Trading?

Now, you might ask, "Why should I care about how fast a stock's price is changing?" Well, just like a speedometer in a car helps you know if you need to speed up or slow down, the ROC helps traders see if a stock's price is accelerating (going up faster) or decelerating (going down faster). This knowledge can be crucial in making timely and informed trading decisions.

How to Use the ROC in Trading

Okay, so we now understand that ROC is our trading speedometer. But how do we use it? If the ROC is going up, it signals that the stock's price is rising quickly. It might be a good time to hop in and buy, just like you might want to accelerate when you see an open road ahead. Conversely, if the ROC is falling, it signals that the stock's price is dropping fast. This could be a good time to sell and prevent potential losses, like you would want to hit the brakes if there's a roadblock up ahead.

Conclusion

To sum up, the ROC works like a speedometer in stock trading, helping traders understand how fast a stock's price is changing. It's a vital tool that aids traders in gauging price acceleration or deceleration. However, remember that while these tools can help navigate the trading journey, they can't perfectly predict the future. Therefore, keep exploring and learning about other technical indicators to equip yourself better for the ever-changing stock market.